2025 Q3 CIO Letter: Flooring It on a Fog-Covered Highway

Written October 27, 2025

I wanted to take a moment to recognize that we celebrated our third anniversary in July. This milestone reflects not only the growth of our firm, but the strength of the relationships we’ve built along the way. It is an incredible privilege to partner with you, to invest on your behalf, and to help you plan your financial future.

Each day, our team shows up energized, inspired, and grateful for the opportunity to do what we love. The passion we bring to this work makes it rarely feel like “work” in the traditional sense. We hope that enthusiasm and curiosity are evident in every conversation.

Thank you for being part of this incredible journey and for the confidence you place in us. We look forward to continuing to build together.

With that, let’s turn to the markets.

· Q1: Tariffs shock the system → paralysis, “Everybody Freeze.”

· Q2: Rally despite cracks → “Glass Seems Full, Is It a Mirage?”

After a summer where investors cheered the resilience of equities and shrugged off weakening fundamentals, the end of the quarter hinted that gravity still exists. The divergence between asset prices and underlying economic reality has continued to widen. Uncertainty persists and the deterioration in reporting standards and response rates for economic and survey data has made it increasingly difficult to discern the true state of the economy, “The Fog-Covered Highway”.

Compounding this, much of today’s market activity is occurring in the private sphere, where problems only become visible once conditions have deteriorated significantly. Meanwhile, public markets appear to be “flooring it” into the fog. Perhaps the road stays straight, maybe there’s a hairpin turn or, worse, a cliff. President Trump continues to treat market performance as a report card, and investors are taking full comfort in that. We are driving much more cautiously, and market internals signal that degree of caution is warranted.

The glass that looked “full” in June now shows cracks around the edges. Investors still hope rate cuts will save the day. The S&P 500 is priced for perfection and sentiment remains highly bullish, but other assets, such as gold, suggest a desire to hedge against risk.

Economic Overview: A Slowing Engine

The economy has plateaued at roughly 2% of real GDP growth year-over-year. Government spending, while still positive, has slowed this year. Consumption has remained resilient while net exports (not shown) and investment have been volatile.

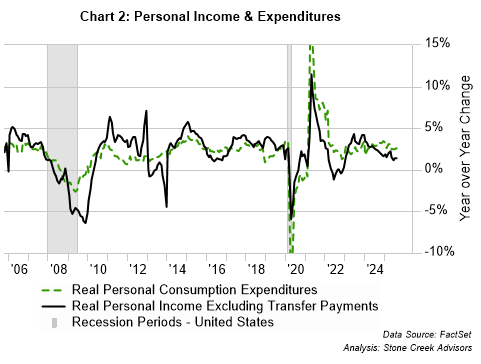

Over the past year, consumption has moderated but stayed healthy. Strong equity markets have supported spending through the wealth effect, but consumers look stretched. Real personal consumption expenditures growth has outpaced real personal income growth since 2023 (Chart 2), meaning additional spending has been fueled by reduced savings or higher debt. The personal savings rate continues to decline while consumer debt, delinquencies, and signs of labor market stagnation point to mounting strain.

Some aspects of the “One Big Beautiful Bill Act” (OBBBA) may provide marginal support next year, but if job growth turns negative, it is unlikely to be enough to overwhelm the impact of an increased unemployment rate which will exacerbate current strain.

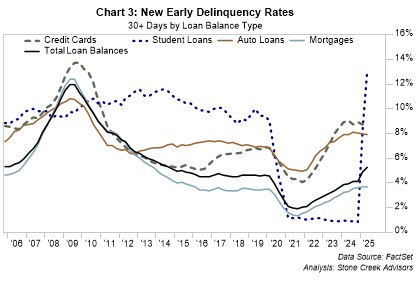

Consumer health looks very bifurcated. Higher-income households continue to spend, but delinquencies on auto loans are suggesting this may be changing. According to a study by Vantage Score, prime and near-prime borrowers were missing car payments at a faster rate than subprime consumers.[1]

Delinquency rates across credit categories are increasing (Chart 3), compounded by the resumption of student loan payments. After a three-year pause and a one-year “on-ramp” that shielded borrowers from negative credit reporting, missed payments are now showing up on credit reports. These delinquencies are impacting borrowers’ credit health and limiting future borrowing ability.

As noted in prior CIO letters, government has driven the bulk of employment growth over the past two years (Chart 4). Government spending (green line in Chart 1) has exceeded expectations, acting as a strong and consistent driver of growth since the beginning of 2023, even though the broader economy was relatively healthy. This strength came alongside rising deficits and debt levels. As rising interest expense crowds out non-defense discretionary spending, visible in Q2’s economic growth data, we believe government spending will be a lower contributor to growth going forward absent a recession.

Investment has historically been the most volatile component of GDP. On the consumer side, new home construction was robust in 2024 but turned negative in 2025. On the business side, technology-related investment (computers, peripherals, chips, and data centers) has surged reflecting the buildout of AI infrastructure and data grids. We expect this momentum to continue, though some demand was likely pulled forward ahead of tariff increases.

In Q2 2025 AI-related investment was offset by a deterioration in other forms of investment spending. If corporate revenues soften and overall business and political uncertainty stay elevated, we are likely to see a continued stagnation of growth under the cloud of uncertainty.

Is Inflation Back Under Control?

Inflation is 3% year-over-year, still well above the Fed’s 2% target. We continue to believe tariff-related cost pressures will feed through to prices in some capacity. The effective tariff rate began increasing meaningfully in May, reaching 10% in June and 19.2% by the end of September. Companies built inventories in advance, but those buffers have now been largely depleted. As a result, cost pressures are now beginning to appear in supply chains, and we will likely start seeing inflation in the data. However, if the economy weakens, it may be difficult for companies to pass higher costs to consumers. That would compress margins, while keeping headline inflation subdued.

Three other factors that previously helped cool inflation could reverse.

1) Restrictive interest rates: High policy rates helped tame inflation, but the Fed’s return to easing in September could reignite demand pressures.

2) A strong dollar: A very strong dollar dampened import costs, likely lowered inflation expectations, and lowered input costs, improving corporate margins. However, the dollar has weakened notably year-to-date.

3) Low oil prices: Any increase in oil prices, perhaps caused by a geopolitical flare-up, could increase inflationary pressures.

Internationally, alliances are realigning in response to these policy shifts. Supply chains are slowly adapting and moving, but at a cost of efficiency and stability. As we’ve written before, the “new normal” is likely to feature higher defense spending, elevated geopolitical risk premiums, and structurally higher and more frequent inflationary pressures.

Gold and the Shifting Monetary Landscape

Gold is on pace for its strongest calendar year since 1979, fitting given the parallel to that era’s mix of large deficits, persistent inflation, and geopolitical strain, all of which have reemerged to test global confidence in fiat currencies.

This surge reflects a convergence of factors: heightened geopolitical tensions, central banks diversifying away from US Treasuries, mounting inflationary pressures, concerns about fiscal sustainability across several developed nations, questions over the Fed’s ability to maintain independence, and softening economic data. Lower bond yields and a weaker dollar, historical competitors to gold, have further amplified golds appeal.

Gold is sending a message: the world is changing, and the monetary landscape is shifting. Unlike paper currencies, gold does not rely on a central bank, makes no fiscal promises, and cannot default. It is indestructible, finite, and trusted, money in the purest form. Central banks, particularly in emerging markets, are recognizing this. For the first time since the mid-1990’s gold holdings now exceed US Treasuries as a share of foreign reserves. Given the gold market is only a fraction of the size of the Treasury market, continued diversification could have an outsized impact on prices.

Recently, this movement is part of a broader “debasement trade” as investors seek refuge from weakening major currencies in the perceived safety of Bitcoin, gold, and silver. Fiscal and political challenges are not unique to the US. Europe faces its own strains, with instability in France highlighting the tension between fiscal restraint and social demands. Across Europe, Japan, and the US ballooning debt levels are a concern.

US Treasury issuance remains heavy while foreign demand is waning. Long-term yields rose in the third quarter, not due to stronger growth, but because investors now demand greater compensation to hold US debt. In this environment, gold’s role as a store of value and insurance against uncertainty and financial excess is proving indispensable.

Federal Reserve: Between a Rock and a Hard Place

The Fed resumed its rate-cutting cycle in the third quarter, strengthening the market rally. Fed Chair Jerome Powell’s commentary since then emphasized labor-market conditions, leaving investors expecting additional cuts this year.

The Fed faces an unenviable dilemma: cut rates to cushion growth and risk reigniting inflation or hold steady and risk exacerbating stress points in real estate, regional banks, and credit markets. President Trump’s vocal criticism of Chair Powell has increased concerns surrounding central bank independence. Any misstep could damage credibility.

Over the last two weeks, the Fed’s Standing Repo Facility (SRF) has been tapped frequently, pointing to tightening liquidity conditions that may force the Fed to stop its balance sheet reduction. The SRF is meant to keep short-term interest rates stable and keep money markets functioning smoothly by offering overnight loans to banks and other institutions in exchange for high-quality collateral, such as US Treasuries, which are repurchased the following day at a small interest cost. This mechanism prevents spikes in borrowing rates.

In mid-October, SRF usage surged. On October 15–16, banks borrowed over $15 billion, the largest two-day total since the pandemic. Another $8.4 billion was borrowed on October 27. [2] Such activity outside of quarter-end is rare and could signal growing stress.

While equity markets seem relatively unphased by growing credit concern and issues with some of the loans made by regional banks, tightening liquidity can spill over into risk assets. Liquidity is a key driver of market performance, so we are paying attention.

Artificial Intelligence

We have no doubt that AI is real and transformative, akin to electricity or the internet. Yet, as with every innovation cycle, markets may be running well ahead of fundamentals. Asset price bubbles often coincide with investment booms.

Many of today’s AI leaders are high-quality companies with strong earnings and solid balance sheets, a stark difference from some prior speculative manias. AI will reshape industries, replace jobs, drive productivity, and ultimately support global growth. However, recent surveys from MIT and the US Census Bureau suggest efficiency gains and broad-based adoption are still limited outside of the tech sector.[3][4] AI literacy is still limited, especially among senior management teams.

With expectations sky-high and valuations stretched, the risk of earnings disappointment looms large. Any slowdown in revenue or spending among the biggest AI spenders, many of whom are allocating around 60% of operating cash flow to capital expenditures, could trigger a reassessment of future returns and valuation multiples. The emerging issue of “circular financing” adds another layer of fragility.

A further challenge lies in energy demand. Power requirements for AI infrastructure are growing rapidly and are a bottleneck for scaling. This dynamic reinforces our conviction in the utilities sector where supply is constrained, and the risk of overbuilding is still low.

Investment Implications: Staying Disciplined

The current consensus assumes a resilient US economy, AI related investments, and more easing by the Fed will continue to underpin corporate earnings. The rising tide has lifted all boats, even for companies with poor fundamentals. In the credit markets, this allowed companies to refinance, delaying negative outcomes. Recently, it seems the landscape has changed as softening economic data, trade tensions, and geopolitical risks have people paying attention to credit specific factors again. The number of negative outcomes in the high yield space over the first half of the year has tripled. This becomes self-fulfilling as people are reminded that companies can and do fail. They demand a higher yield or refuse to lend all together, starting a default cycle.

Correlations and market internals are breaking down. Sentiment is very bullish, but it seems to be more complacency than a high conviction rally. Today’s valuations require caution. No matter which way you cut it, the market is expensive. Comparing the total value of the US stock market to the size of the economy, Warren Buffett’s preferred barometer, valuations are at historically elevated levels, eclipsing numbers as far back as the 1920s. High valuations don’t necessarily trigger selloffs, but they amplify downside risk if the economy or earnings disappoint. Corporate earnings expectations for 2026 remain high and the next-twelve-months Price to Earnings ratio on that growth rate is elevated. This market is the most concentrated ever, with the top 10 companies making up over 40% of the S&P 500 market cap and the tech sector at 52.6% of the Russell Growth Index.

Our approach remains consistent: diversify, protect, and wait for opportunities where valuations reset closer to reality.

We are maintaining exposure to defensive equities with strong balance sheets, reliable cash flows, and pricing power.

We have significant exposure to companies that pay and continue to grow their dividends. The resumption of the rate cutting cycle has increased the attractiveness of this factor. Historically, when the Fed has begun cutting interest rates, this factor has outperformed.

We continue to hold meaningful allocations to short-term Treasuries and gold, as a ballast against uncertainty.

We are incrementally allocating abroad where valuations and fundamentals are more favorable, particularly in developed markets.

We remain underweight consumer discretionary, real estate, and highly leveraged companies, where risks are amplified by the current environment.

Periods of complacency can persist longer than many expect, but history shows they rarely end smoothly. With earnings expectations still too high and valuations stretched, we prefer to add risk selectively on weakness.

Conclusion: Cautiously Navigating the Fog

In investing it is impossible to predict exactly what is going to happen. However, we can plan for the possible range of outcomes and position client accounts accordingly. Some days, driving visibility is perfect and you can cruise smoothly, reaching your destination safely and faster than expected. Other mornings, the fog thickens, slowing down traffic and increasing caution. You leave earlier, giving yourself margin for the unexpected. There is little downside to arriving ahead of schedule but there could be real cost to speeding down the fog-covered highway. In uncertain conditions, it is the range of possible outcomes, not the average that shapes your decision.

Investors face a similar challenge when planning for their financial goals. The future path of markets often resembles that foggy highway: unclear, variable, and full of potential detours. While expected returns can help set direction, the true test lies in navigating uncertainty without falling short of what is needed to sustain one’s lifestyle. When visibility is poor, prudence matters more than speed.

Assets with higher risk may offer a faster route to wealth, but they also widen the range of possible outcomes. If the fog thickens and markets stumble, falling below the minimum required return may be too great a risk, especially if you are living off those assets. In goals-based investing, just as on a foggy morning commute, success depends less on how fast you could go, and more on ensuring you arrive safely, regardless of the conditions.

The third quarter reinforced what we’ve been saying since the start of the year: the surface looks calm, but structural risks are building underneath. Whether it is tariffs, deficits, liquidity or credit concerns, or central bank credibility, the potential triggers for market repricing are numerous.

We cannot predict which shoe will drop, but we can prepare by diversifying across asset classes and geographies, focusing on quality, and avoiding overpaying for growth. Markets could continue to floor it down the fog-covered highway, but eventually they may find themselves driving off the edge of a cliff.

As always, thank you for your trust and partnership. Please reach out with any questions.

Kasey

[1] https://www.bloomberg.com/news/articles/2025-10-17/auto-loan-delinquencies-jump-50-as-car-prices-reach-new-heights?srnd=homepage-americas

[2] https://www.newyorkfed.org/markets/desk-operations/repo

[3] https://mitsloan.mit.edu/ideas-made-to-matter/productivity-paradox-ai-adoption-manufacturing-firms

[4] https://www.apolloacademy.com/ai-adoption-rate-trending-down-for-large-companies/

One Seven (“One Seven”) is a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). Registration with the SEC does not imply a certain level of skill or training. Services are provided under the name Stone Creek Advisors, LLC, a DBA of One Seven. Investment products are not FDIC insured, offer no bank guarantee, and may lose value.