2025 Second Quarter CIO Letter: The Glass Seems Full, Is It a Mirage?

Written July 9, 2025

“I may do it; I may not do it. I mean nobody knows what I’m going to do.”-President Donald Trump

This quote was taken from President Trump speaking on the possibility of an American strike on Iranian nuclear installations, but it is just as fitting for economic policy in the first half of 2025 and likely will remain the case in the second half of the year as well.

We are at peak uncertainty in some ways today, as these new tariff rates are announced, even as US equity markets are reaching new highs. He is right, no one knows what he will do next. This seems to be his preferred way of governing. In this environment, it is essential to stay focused on the bigger picture and assess whether the daily news flow truly affects it.

Introduction

At first glance, only considering the S&P 500’s 5.5 % return through the first half, 2025 might appear to be a typical year. For an investor waking up from a long nap, it might even seem like a resounding success: equity indices are at or near all-time highs, volatility (as measured by the VIX) is low, and risk assets continue to climb. But a closer look reveals a far less idyllic story.

The market is priced for perfection, and yet, perfection is nowhere to be found. Economic data has been slowing since the beginning of the year, growth projections worldwide have been marked down for 2025, tariff uncertainty remains heightened, the deficit is continuing to increase, and market internals are deteriorating. Valuations do not leave a cushion for disappointment unless the market continues to just look through weakness as transitory. Investor confidence in artificial intelligence or the “Big Beautiful Bill” being able to be the near-term savior may be misplaced. Is the strength they are seeing genuine or simply a mirage?

Economic Overview: Cracks Beneath the Surface

Economic data has been broadly decelerating since the beginning of the year. The most recent Fed Beige Book shows economic activity in three-quarters of the country is now contracting or stagnating. Global growth projections have been revised downward and in the US we are facing sluggish demand with the potential for inflationary pressures.

Although the latest headline labor market data looked healthy, the underlying strength was hollow. Job gains were heavily concentrated in the public sector, with private employment growth softening and hours worked declining. Continuing claims are the highest since 2021 and the unemployment rate looks to have artificially stabilized recently due to a weakening labor force participation rate.

President Trump’s 90-day pause was announced a few hours after our last CIO letter was sent out. Since then, the economic outlook has improved, and the financial plumbing does not look as strained. While the probability of a recession is lower than in April, the risk of a recession or stagflationary environment remains high. The unpredictability of this administration could change our outlook quickly.

There are two areas that have not retraced their losses this year. The US dollar, a traditional safe haven, has had a very rough start to the year. Longer-dated Treasury yields have been quietly climbing (though with more volatility than the dollar’s fall), reflecting both fiscal strain and waning faith in American exceptionalism. Together, these dynamics point towards the possibility of rising risk premiums across U.S. risk assets which equity and credit markets have yet to price in.

The lack of lower rates is also negatively impacting the commercial real estate market where office delinquencies exceed 11% with many lenders allowing for temporary reprieve. Without a decline in interest rates soon, defaults could escalate sharply and even with the decline in rates, oversupply and slow return-to-office trends are likely to still drive down prices. We are keeping an eye on the commercial real estate sector as it could be a key transmission point for broader financial stress. Rising defaults could ripple through regional banks and credit markets, tightening lending standards further and amplifying the economic slowdown.

Trade Tensions and Geopolitical Instability

The largest tariff hike in over seventy years was implemented in the second quarter with surprisingly muted consequences thus far. Much of this may be attributable to the front loading of imports in the first quarter, however we expect a payback period in the second half as inventory buffers are exhausted, new orders slow, and tariff-led price increases are felt. The shock and awe of the original numbers introduced on “Liberation Day” psychologically made the, still significant, rates implemented during the 90-day pause seem minimal. The pause just delayed uncertainty.

As of this writing, we are in the middle of President Trump relaying new tariff rates to countries. So far, most rates announced the same or higher than the first time around, and he seems particularly angry at the BRICs. However, with the announcement of the August extension until payments begin, markets seem to be operating on the hope, not the certainty, of a better resolution with most countries. If those hopes fade, risk assets could experience another major selloff.

The world is experiencing a global realignment, filled with uncertainty. This increases the likelihood of long-term supply chain restructuring, higher defense spending, and persistent inflation. This environment creates an upside risk to inflation and downside risk to potential GDP growth, factors not fully accounted for in most asset prices.

Fed Policy and Market Psychology

Investors appear confident the Federal Reserve will counter any economic weakness with rate cuts and will look through any inflationary pressures as transitory. While we do expect the Fed to ease policy, it remains to be seen whether this will be reactive or preemptive, and whether the Fed is once again behind the curve. President Trump wants lower rates to help deficit concerns as a lot of the short-term debt accumulated during the pandemic now need to be rolled over at much higher rates.

Rate cuts in a rising inflation environment carry their own risks, particularly to Fed credibility. A policy misstep could entrench inflation expectations or signal panic, both of which could roil markets. In such an environment, defensive equities characterized by stable earnings, lower beta, and pricing power have historically outperformed. We remain overweight these types of companies in our client portfolios today.

Meanwhile, the long end of the yield curve is caught in a tug-of-war between softening growth and rising fiscal concerns and Fed credibility and independence. Treasury supply is surging while foreign demand has waned, and as deficits expand, investors are beginning to demand higher compensation for risk.

Political Volatility and Governance Risk

President Trump’s return to the Oval Office has injected renewed uncertainty into policy forecasting. The administration’s erratic communication style and rapid policy shifts, especially on trade and the Fed, make it difficult for businesses to invest and plan long-term both in the US and abroad.

The ongoing public tension between President Trump and Fed Chair Powell raises legitimate concerns over central bank independence. Trump has not been quiet on his dissatisfaction with Powell and, while a tenuous relationship between the President and Fed Chair is not uncommon throughout history, it remains concerning. History shows markets are sensitive to even the appearance of political interference in monetary policy.

Investment Implications: Strategy for an Uncertain Second Half

The sheer unpredictability of this administration makes catching every move in the market impossible. Instead, it forces us to look longer term and amplifies the importance of being diversified. Diversification allows us to participate in a multitude of scenarios and uncorrelated assets protect the portfolio on the downside. Today, the income in fixed income and dividends creates some predictability. We are also becoming more globally diversified as we are finding better valuations and economic cycle positioning abroad. We see our preference continuing to shift outside the US if current trends persist. We continue to like high-quality, defensive equities with strong cash flows and pricing power. We still hold a lot of short-term Treasuries as well as gold.

We are avoiding areas of the market that look overextended in terms of expectations as well as valuations. This has kept us out of the broad US equity market indices as they have very concentrated exposures. In this environment we want to avoid office real estate, consumer discretionary, and financials and are underweight companies where growth is well into the future and companies with poor balance sheets.

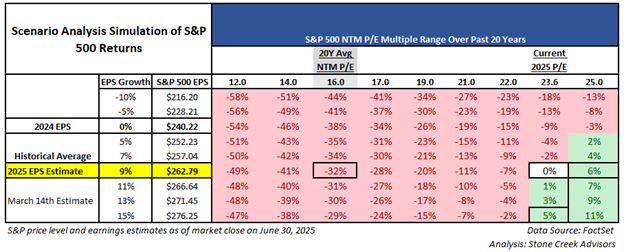

During the sell-off we added risk to our client portfolios but over the last month we have pared much of that back. We believe this rally has been emotionally, instead of fundamentally, driven. Earnings expectations for 2025 have come down from the start of the year from over 13% to closer to 9%. This means, for the market to be up from there, the multiple investors are willing to pay for each dollar of earnings has increased. Would you pay more for earnings today than you did at the start of the year knowing what you know now versus what you did then? Buying today would be hoping that earnings growth is better than the 9% that is now being expected, or that investors are going to continue to pay more for each dollar of earnings. Remember, a trade war could directly impact earnings through slowing revenue growth or narrowing margins and moving supply chains will have immense costs that are also likely to hurt margins.

You probably would not be buying today, but what would it take for you to sell? Overbought markets can stay overbought for long periods and exuberance can stay in place until there is enough contrary evidence. Market internals are poor with fewer stocks setting new highs within the S&P. The lack of breadth has historically brought subpar returns over the next year. We will take advantage of market sell-offs and better valuations as they begin to price in what we think is a more reasonable reality.

Conclusion: Full, But Fragile

The glass seems full, but perhaps dangerously so. Markets are buoyant, but not by fundamentals. Economic conditions are weakening, risks are rising, and valuations offer little room for disappointment. Investors are betting heavily on Fed support, geopolitical stability, and continued consumer resilience, none of which are guaranteed.

Hope is not an investment strategy. In this environment, diversification is not just prudent, it is essential. By allocating across geographies, asset classes, and strategies, investors can build portfolios capable of enduring a variety of outcomes.

The mirage of strength may persist, but it is wise to prepare for the possibility the illusion dissolves.

As always, please reach out with any questions.

Kasey

One Seven (“One Seven”) is a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). Registration with the SEC does not imply a certain level of skill or training. Services are provided under the name Stone Creek Advisors, LLC, a DBA of One Seven. Investment products are not FDIC insured, offer no bank guarantee, and may lose value.